As we just came off the rush of the 2022 Tax season, I hear my usual complaints, I pay too much in taxes. My friend did not pay as much as me! They even got a refund. Where am I going wrong?

The answers are usually quite simple. Where did we go wrong? Did you take advantage of the low hanging fruit of tax loopholes, capital gains, and deferred income? Did you tax plan? Every year we get the same questions. And every year we give the same answers. However, this year I seem to sense that people are unaware of the tax bracket they are in and do not review their own paystub.

I have summarized the issues into three touch points. So if you pay attention to this you will pretty much eliminate large payments to the tax man. It is as easy as 1-2-3 to lessen your tax liabilities.

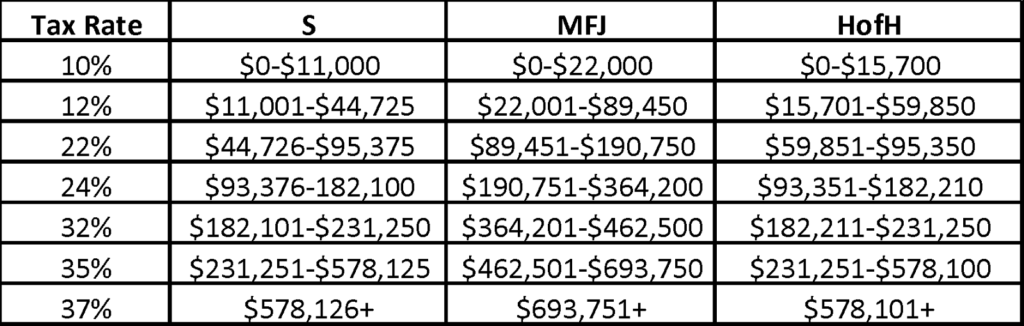

- Know your tax bracket. If you are a two-income family. Make sure you account for your combined bracket. This is biggest reason: “payroll software did not take out enough.” The 2023 tax brackets are:

- Tax deferment. Contribute to your Traditional 401k, 403b, 457 or Individual Retirement Account (IRA) for the tax deferment. Every amount you contribute to your retirement will generate tax savings using the latest tax rates. For example, if you contribute to a Traditional IRA $6,500 which is the maximum amount allowable in 2023. Your tax savings if you are in the 22% tax bracket would be $1,430 ($6,500*22%).

If you have a company sponsored 401k or other tax deferment plan with a company match, be sure to maximize the amount to get free money. So, if your company says they will match you 100% for the first 6% you contribute, be sure to contribute at least the 6%. It is amusing how many people do not contribute the amount needed to get the maximum match. It is FREE MONEY. Let’s assume you are in the 24% tax bracket and you contribute $5,700. Your tax savings will be $1,368 plus you will receive $5,700 FREE MONEY from the company match. According to the Federal Reserve SCF data, the Average retirement savings is $148,950 and the Median is $100,00.

- Long-term capital gains over ordinary income. Re-read the blog of Pay-0% income tax published last 2/22/2023 on our site. Bottom line is the Capital Gains tax rates are in your favor. Strive for Qualified Dividends over ordinary dividends, Long-term capital gains on schedule 1099B over short term. Remember the Capital Gains rates are 0%, 15% and 25%. Pay attention to when you sell your assets – It can be costly.

Reducing your tax liability does not take a lot of effort. It only takes self-review and self-discipline to follow through on a few simple ideas. Simple steps but can save you thousands of dollars.

Want to learn more?

You may want to consult and work with 1099 Accountant – we offer online bookkeeping, online advisory services and online tax and accounting services. We offer reasonable rates. We only work with digital nomads, independent contractors, freelancers, and one-person business. We work with locum tenens from California to New York City and everywhere in between. And yes, even Hawaii.

Contact us toll-free (855)529-1099 or make an appointment for a free consultation. https://1099accountant.com/contact/