In general, self-employed residents of the state of California (CA) or non-residents that receive income from a source in CA of at least $500 ($250 if married/RDP filing separately) in a year are required to make quarterly estimated CA state taxes.

California Quarterly Estimated Tax Deadlines

The due dates for California state estimated tax payments align with the Internal Revenue Service’s (IRS) quarterly deadline:

| Quarter | Due Date | Period |

| 1st | April 15 | January to March 31 |

| 2nd | June 15 | April 1 to May 31 |

| 3rd | September 15 | June to August 31 |

| 4th | January 15 (the following year) | September 1 to December 31 |

California State Income Tax Rates

The state of California currently has 9 tax rates, ranging from 1% to 12.3%. The applicable CA tax rate will depend on the individual’s filing status and income tax bracket. Taxpayers who earn more than $1 million are subject to an additional 1% mental health service tax. Visit their official website for the yearly tax calculator, tables, rates at FTB.ca.gov.

How to Pay California Estimated Taxes Online

There are several options to pay your California state estimated taxes online. You can pay with your bank accounts or credit card account (with a fee).

Pay your taxes free of charge by using any of the following options:

- Web Pay with MyFTB account – You must create a MyFTB account to use this option. You can use your checking or savings account to pay various California tax obligations such as a tax bill or balance due, current year or amended return, estimated tax payments, extensions, etc. You can also do the following:

- View, schedule, and cancel payments

- Access your tax information and history

- Reply to tax notices

- File California taxes for free, if you qualify.

- EFW (electronic funds withdrawal) using approved tax preparation software.

Paying online is the most efficient and secure way to make your estimated tax payments. However, if paying online is not possible, you may pay either in person at a field office or by mail using check or money order. You must also use the Estimated Tax for Individuals (Form 540-ES) vouchers if you opt to pay your estimated tax by mail.

How to Pay California Estimated Taxes via Web Pay

Below are the steps to make your California estimated tax payment online via Web Pay.

- Create a MyFTB account of FTB official website. You will need your latest California tax return information to create an account. If you have never filed a return, you must contact the Franchise Tax Board for assistance.

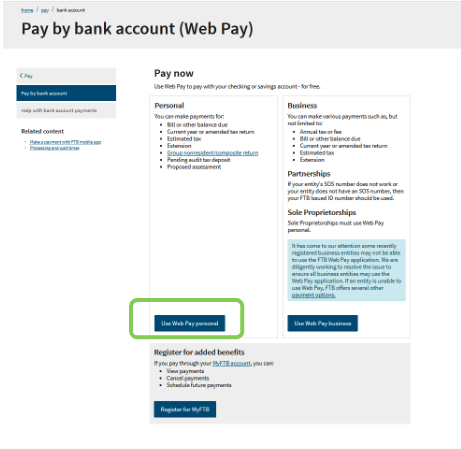

- Go to the official Web Pay page at FTB.ca.gov and click ‘Use Web Pay Personal’.

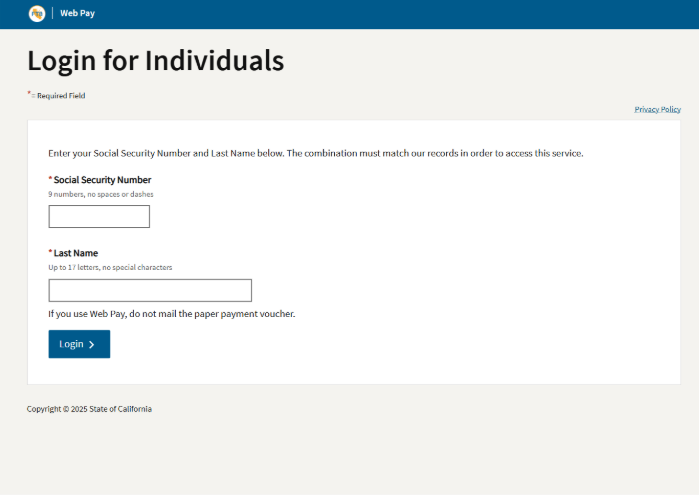

- On the next page, input your social security number (SSN) and last name, then click ‘Login’.

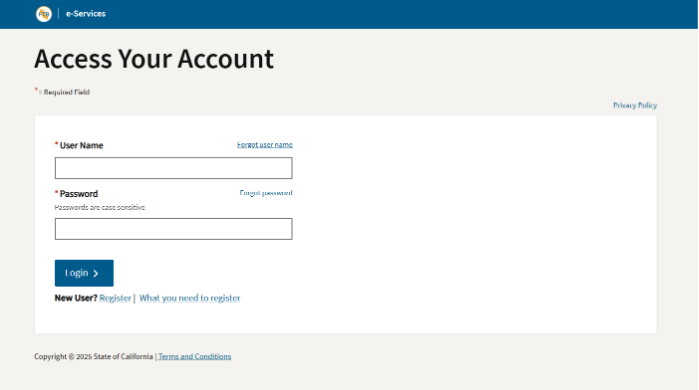

- To access your account input your User Name and password, then click ‘Login’.

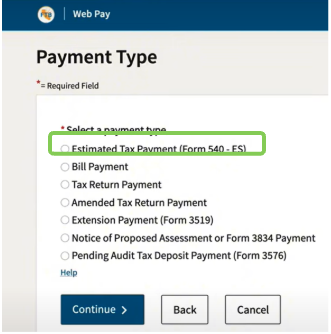

- Payment Type. Select ‘Estimated Tax Payment (Form 540-ES)’. Click ‘Continue’.

- Tax Information. On the next page, select the applicable tax year, input the amount of payment, and the date you want your payment to be paid. You may also schedule tax payments on this page.

- Bank Account Information. Provide your bank information to proceed with the payment.

- Save Payment Confirmation. Done! Be sure to print or save a copy of your payment confirmation for documentation and tax filing reference.

If you’re self-employed—independent contractor, locum tenens, CRNA, freelancer, gig worker, or a small business owner, it is your responsibility to pay quarterly estimated taxes on the federal and state level since you do not have an employer to withhold taxes from your income. Doing so helps you avoid large tax bills and penalties at the end of the year.

Not sure how much to pay for your quarterly taxes?

You may want to consult and work with 1099 Accountant – We offer online bookkeeping, online advisory services and online tax and accounting services. We offer reasonable rates. We only work with independent contractors, freelancers, and one-person business. We work with locum tenens from California to New York City and everywhere in between. Yes, even Hawaii!

Contact us toll-free (855)529-1099 or make an appointment for a free consultation. Contact Us

Sources: FTB.ca.gov